SMB market in India

I am Aarihant Aaryan! Welcome to the Iron sharpen Iron newsletter,

I share my weekly homework from my startup journey, learning about human behavior, and sometimes decoding industries and business models for fun.

I can’t control my curiosity :) )

I have been building in the Small business space for more than 2 years, tried making products in many verticles that could life of a business owner more efficient.

In the last 2 years, I have had conversations with 500 business owners, and 200+ CA’s & researching for 100’s hours + I found insights and truths that are extremely contrary to many founders and investors who are building in the SMB space

Today I will be sharing all my notes, probably this will be one of the editions in Iron sharpen Iron where you will have too many takeaways.

Bursting the Bubble:

Many people in India think there are more than 70M+ small businesses which is not true.

In a real sense, Indian SMBs are categorized into two segments

Business

Merchants

There are close to 15M Businesses and 15M merchants in India who actually do business on day to day basis.

One of the unknown facts about India is most of the people are unregistered traders or resellers, they help goods move from one place to another and charge a commission.

Business segment:

There is a maximum of 15 million businesses that have active GST accounts, India is not like western markets.

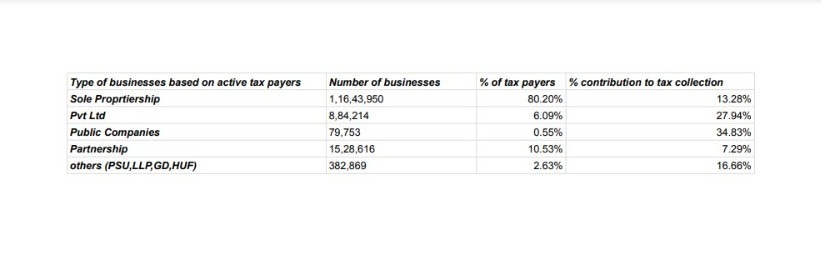

We aren’t a private limited company market but a sole proprietor market - Which means there is only one owner in the business, the business starts and ends with him. A single man's show.

Most of the sole properties don’t even have employees, they own freelance contractors.

Close to 81% (11.6M) of businesses in India are sole proprietors, and there are only 0.9M businesses that are private limited which is 6% of the entire Indian business landscape.

There is also a massive power law, Public companies, and private ltd companies who are just 7% of the entire business landscape contribute to 63% of tax collection

Out of 15M businesses - Maharastra, Uttar Pradesh, Karnataka, and Tamil Nadu have 8.25 M businesses and these 4 states contribute to 44.3% of total tax collection.

(If you’re building a tech product for businesses these should be the first state you should penetrate)

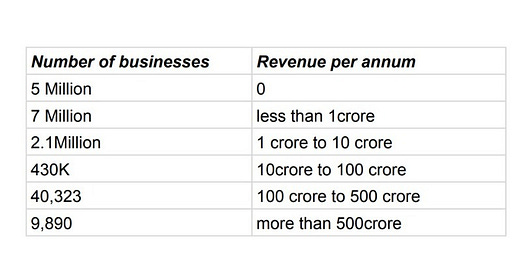

How much do businesses in India Make?

Often on LinkedIn and Twitter, people criticize and mock startups that they don’t make money. Truth it is hard to make money, India’s market in terms of income hasn’t matured yet. If you observe the above stats:

9,890 businesses make more than 500crore in revenue

40,323 businesses make 100cr to 500cr in revenue

430k+ businesses make 10cr to 100cr in revenue

2.1M+ businesses make 1cr to 10cr

Close to 7M+ businesses make less than 1 crore, and Another 5M businesses don't make anything.

Merchant Segment:

The merchant segment is categorized into 3 parts

Distributor

Wholesaler

Retailer

In India, there are close to 60,000 distributors / 33Lakh wholesalers, and 12 million retailers.

Most people talk about kirana shops (retailers) dying because of tech, that is extremely bad reasoning - they clearly don’t understand power law.

Most of the retailers or wholesalers in fact don’t make money because

Low gross margin business, once

There is a huge power law - that one marwadi shop would make 5x more revenue than any other retailer

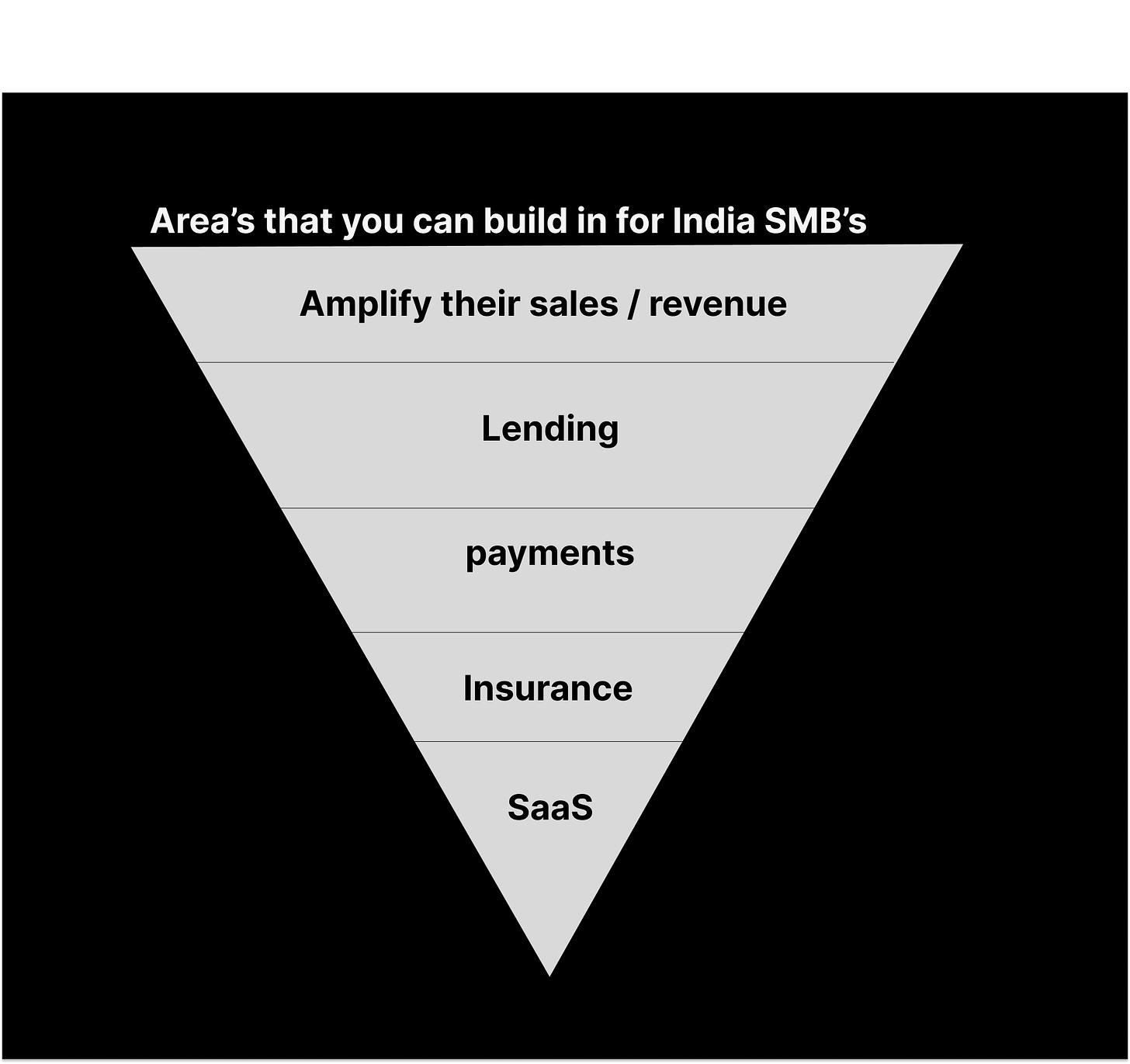

How to build for Indian Businesses?

AMPLIFY SALES AND REVENUE:

Any business in India that can help the consumer make more money or give hope to make more money will eventually prosper

Marketplace models like amazon, Flipkart, cred, and swiggy:

Amazon’s revenue in India last fiscal year is $ 2.5 billion, they help sellers make more money. Amazon made more than $300M by ads.

Businesses don’t mind advertising on your platform if you can help them get more sales or businesses don’t mind giving you a cut in their revenue if you help them sell.

Import & Export:

Import and Export is a very huge opportunity as it gives business owners a chance to spend INR and earn in dollars. Even TATA’s 50% of revenue comes from TCS - which is into exporting tech services to the west.

The biggest friction for business owners is getting a lead or processing the entire transaction, a business can be built if you can streamline the process.

LENDING:

Loan products like Invoice based financing, business financing, supply chain-based financing, revenue-based financing, or credit / corporate cards have a huge opportunity. The market is underpenetrated

Business Loans has a Portfolio outstanding of ₹ 5.49 Lakh cr as of Mar’21, with 16% Y-o-Y growth by value and 30% by volume

In March’19 there were 11.2M Business Loan accounts

In March’20 there were 10.1M Business loan accounts - YoY growth -9.42%

In March’21 there were 13.2M Business loan accounts - YoY growth - of 29.87%

Public Sector Banks and NBFCs dominate Business Loans (by value). Private banks and Others also have a good presence

The average Ticket Size of Business Loans is INR-5.9Lakhs

33.8% of Business Loans were provided to New to Credit (NTC) borrowers in FY21

The only problem with the lending business that is often avoided is the cost to disburse a loan and ability to the disburse a loan per 100 applications

Out of 100 loan applications a lender receives, they can only lend to 1% of them and the average cost to disburse a loan is INR 50,000 for a loan cheque size of 5Lakhs.

PAYMENTS:

Digital payment collection for SMBs has huge potential, helping them with international payment collections, and recurring payments - It is also a huge gross margin business.

Look into the journey of stripe, it’s fascinating - Razorpay which is a market leader in India will be one of the biggest companies.

Insight: A business pays Razorpay a 2% commission for every payment received but the same business doesn’t pay 200rs per month as a subscription for software.It is because businesses love to pay for things that face the customer and inherently have the habit of doing “Jugaad” for their backend business works (Inventory management, making bills)On the UPI side, there is no way to make money from merchants on payments but still, there are people fighting for market share because it could open up a lot of opportunities for a different line of businesses.

Well, this is called the loss leader strategy. Loss leader strategy prices products lower than the cost to produce them in order to attract new customers or to sell additional products to customers.

This is not a new concept, Selling milk generates losses for grocery shops

Buying milk is a limited purchase since can't be stored for a long time

Selling milk increases the frequency of customer coming to the shop which creates an opportunity to cross-sell or upsell so that it covers the cost and create a margin.

INSURANCE:

Employee wellness insurance: There is a wrong notion that states Small businesses employ more than 110M individuals, but that’s not entirely true.

In India employee wellness insurance won’t work well at this stage in my opinion, there are not many businesses that you can cater to, you can’t expect a business that makes less than 1CR in revenue to give insurance policies to its employees, there are hardly 2.7Million businesses that can be served

Top 10,000 business that makes more than 500cr every year, employs more than 50M individuals. I.e Top 10 public companies employ more than 2.6M individuals+ with all the competition and traditional players’ dominance, there is no huge opportunity in this category.

Probably insurance companies need to curate an employee insurance policy for businesses, onsurity did great work by introducing subscription-based policies.

Asset Insurance for businesses is something that should really work well for Indian businesses, verak has been working well and has seen good traction overall. But the problem is you need to have an army of field agents to penetrate the market.

SAAS:

SaaS for merchants or small businesses won’t work in India, I tried building tools like Invoice management, Inventory management, staff management, and finance management but none of them worked -

I learned SMB owners don’t value time in their businesses but they value money - they would be happy to use a book and pen and get the job done VS relying on tech.

For SAAS products you have to position your product for businesses that make more than 1cr per annum, they are more likely to buy subscriptions.

For Saas to work in India, there has to be a value-added service, Saas+ payments or saas+ marketplace or saas+financing

Insight: when you are building for small businesses in India there is a chance for you to win if you can capitalize on existing behavior.

If you have any thoughts or tips share them in the comments :)

If you found this insightful, do drop a like and tap on share.

A ❤️and share on LinkedIn / Twitter would definitely mean a lot.