How sectors and new businesses evolve in tech?

I am Aarihant Aaryan! Welcome to the Iron sharpen Iron newsletter,

I share my homework from my startup journey every week, learning about human behavior, and sometimes decoding industries and business models for fun.

I can’t control my curiosity :) )

I believe the world runs on the law of efficiency, as every inefficiency is being solved you create value that brings wealth.

Solving inefficiency is not a one time event, it is a everyday process and a process that has to be updated by time.

The same kind of solution that worked in 19th century for banks doesn’t work in 20th century.

It becomes irrelevant and inefficient, once that is solved immense wealth is unlocked.

That’s why i say people don’t solve problems, they solve inefficiency for that time being.

But how are markets and businesses created?

If an operation in a solution is inefficient for more period of time it creates a ineffiency.

Thought: Well how big the inefficiency is directly correlated to number of people experiencing the inefficiency and the impact inefficiency creates - that’s called as market

For ex: Transportation is a big solution, but small inefficiencies that weren’t solved in transport for long time - compounded the impact and size of the inefficiency, once that was solved it created, huge amount of value and wealth.

Look into the journey of ola and uber, the inefficiency that they solved wasn’t a pain early 2000’s but as time progressed it became huge inefficiency for the consumer.

When consumers constantly interacts with an inefficiency , it becomes normalcy for them, it becomes part of their life - they don’t see it as a problem unless you tell them - that’s the reason not everyone got the idea of uber and ola.

Someone who experienced a different behavior had to come and tell consumers it is inefficient, there is a new way out.

The best way to figure out how markets were created from big markets inefficiencies is by looking at the journey of big companies:

Facebook & Google:

Ad spending in the Digital Advertising market is projected to reach US$616.00bn in 2022.

Majority of the revenue for both Google and facebook comes from ads, which is obvious but the last 10 years journey has for these companies has been fascinating.

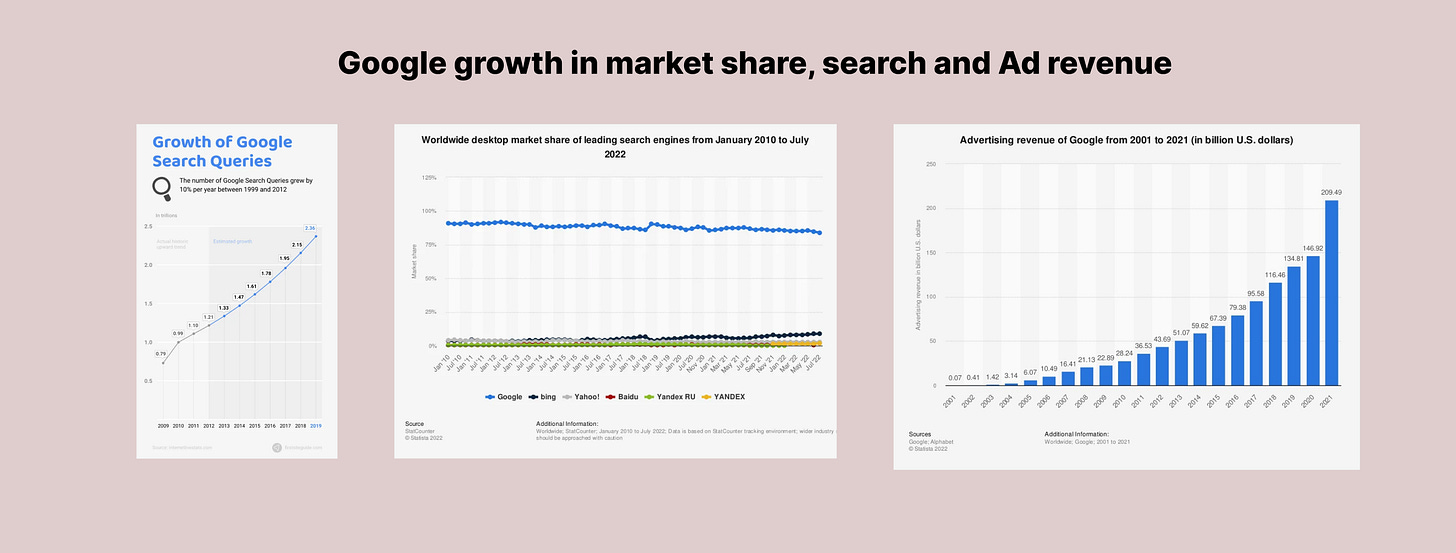

Journey of Google:

Google launched it’s search engine in 1998, from 0 users to 4.3B users, look at the increase in number of searches 0.79Trillion to 2.5 trillion searches and Few million of dollars in revenue to $210B in revenue

All this numbers look amazing, but the scale of users and scale of revenue doesn’t match - it’s less. having 90% of global internet users using google and still 200B in revenue?

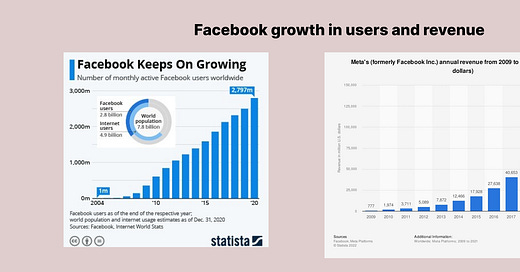

Journey of facebook:

Facebook was launched in early 2000’s from 0 users to 2,797M users it took them 20 years - let’s assume only 50% of them are unique users (which is 1,350M accounts)

That’s close to 35% of total internet users across the globe.

Facebook total revenue is $118 Billion - 97% of the revenue is contributed by ads.

Again the numbers are amazing but there is no correlation between number of users and revenue growth.

The ineffiency that google and facebook couldn’t solve is CTR decay and that affected their revenue badly.

CTR means: Click-through rate is the ratio of users who click on a specific link to the number of total users who view a page, email, or advertisement.

Since these big co’s couldn’t solve for CTR decay, advertisers couldn’t experience a great ROI for their ads - which forced them to move towards new platforms or sector agnostic platforms to drive more revenue by ads.

Online sellers, started opting amazon ads, flipkart ads vs facebook ads - Amazon total revenue was $430B - out of which ad revenue was $31billion

Funfact: Amazon userbase is only 175M, it is close to 25times lesser than google and 10 times lesser than facebook, but amazon with such little userbase it generates around 25% of facebook ad revenue or 15% of google ad revenue.

Restaurants, started opting more for swiggy ads or zomato ads vs going for facebook or google search ads.

swiggy generated more than $30M in revenue by ads, zomato generated close to $270M in revenue ( by ads, subscription and commission - no clear number around ads contribution)

Another example is Banks

Since HDFC, is the largest private bank in India let’s consider them as an example Total number of HDFC bank accounts is 4.9crore - with total revenue of $19.1Billion

But 60% of their revenue comes from retail banking. A significant contributor of retail banking revenue or wholesale banking revenue is always “loans” or different form of loans for banks. Least amount of revenue is generated from different line of businesses.

It’s purely because of the same thing we discussed in the beginning

“Solving inefficiency is not a one time event, it is a everyday process and a process that has to be updated by time”

Under their product offerings, let’s consider 3 line of businesses

Bill payment services

Sale of POS

Tresaury services ( Demat account / brokerage services)

Because HDFC, couldn’t solve for minor inefficiencies - they compounded and turned out to be larger inefficiency which made their users migrate to different platforms.

That led to new markets and sector agnostic businesses.

Payment gateway co’s like razorpay replaced banks payments services, which unlocked significant amount of wealth. As of today i know payment gateway co’s that are having sector agnostic approach.

I.e Razorpay is for small businesses, Jodo pay is payment gateway for educational institutions, I have heard of another co that is payment gateway for hospitals and guess what all these will make an impact and create wealth - that large those inefficiencies are.

Pine Labs is one of the market leaders in POS systems - I haven’t experienced as efficient POS system as pine labs. They replaced banks POS machines. Their revenue growth has been impressive Year on Year.

Not just this, i have not just seen better businesses but new products coming in this space. I.e QR codes, they have more penetration than POS systemsZerodha revenue has $500M in revenue, for a fintech with that revenue and 40% gross profit is huge. Imagine the kind of efficiency zerodha created that they are a market leader not a “BANK”. No bank has made $500M in revenue by brokerage services in India.

I know startups that have new sector agnostic approach or category, zupay a company that is helping teens invest, Jar a company that is helping people invest in Gold and i know another startup that is in stealth trying to help more women participate in investing.

Final thoughts:

We are humans, while solving one effiency - we create another ineffiency.

we have that reputation. This is a cycle, businesses will start with a single utility and try to become everything for everyone in the process they end up creating inefficiencies that will be solved by future entrepreneurs.

A never ending cycle - well, Welcome to the world of ENTREPRENEURSHIP.

If you have any thoughts share them in the comments :)

If you found this insightful, do drop a like and tap on share.

A ❤️and share on LinkedIn / Twitter would definitely mean a lot.