I am Aarihant Aaryan! Welcome to the Iron sharpen Iron newsletter,

Every week I share my homework from my startup journey, learning about human behavior, and sometimes decoding industries and business models for fun.

I can’t control my curiosity :) )

Ps: Today i have introduced something new to this newsletter, many people have been asking me for this in my DM’s and i thought i should give people an opportunity - you will know what it is about, at the end of the newsletter — LESS GOOOOO

Most people believe that Indians don't spend a lot of money

On the contrary, there's a certain pattern that makes an Indian spend more money than westerners

Today, i am going to answer that misconception with an observation i have had an year ago and it is true will prove with some data points that will also help you to understand how Indians use financial instruments:

Indians have an Extreme desire to own high-frequency and high-priced products:

The desire to buy high-frequency and high-value products doesn't end, they want to make constant purchases - seek better versions of the product.

Bikes can be a great example for this segment, there are houses that own 2+ bikes. In 2019, 21M 2-wheelers were brought. Close to 49.7% of Indian households own a vehicle.

But, wait are you thinking, where is the money coming from for these purchases - well keep reading that insight is at the end..

Indians Don't want to own high-frequency and low-priced products:

Indians don't find value in buying products of low value even if they have high frequency. i.e Top 3 printer co's India could barely sell 1m printers in 6months.

Indians love to own low-frequency and high-priced products:

Most of the time these are signaling products, it can be cosmetics or jewelery. Indian households own 11% of the world's Gold - that's worth around $1.5 trillion dollars.

India is the 4th biggest beauty and personal care market in 2021 but per capita wise we stand at 122nd position country-wise.

High Hopium spends:

It's obvious that most of the people in India don't make money

Only 10% of India make more than 25,000 per month but people spend on products that give them the hope of making money, That's why fantasy games are a super hit in India ex: Gvt exams,dream11

One company that I know of helps people to play poker and rummy has more than $1.1Billion in GMV.

Lotteries are illegal in India otherwise they would be the biggest business in India.

But, wait are you thinking, where is the money coming from for these purchases - well keep reading that insight is at the end..

A country of reputation spends:

In India, most families save and compromise on many spending - just to splurge money on major events in life that are linked to their status/ reputation in society. I.e Marriage, education.

An average Indian spends 32,000 on their child's education - that's 30% of per capita income spent on education Any product that helps signal or amplify their signal in society is loved by an Indian.

But, wait are you thinking, where is the money coming from for these purchases - well keep reading that insight is at the end..

Low on financial commitments:

Irrespective of the frequency and value of the product if you are trying to make an Indian consumer subscribe and expect him to pay a monthly subscription.. that's least like to work well or the retention will not play out well.

“But still you could have one question, where are people getting money to buy bikes and consumer goods”

Well I am here to answer that, what else i am here for?

How are people buying 2 wheelers and what’s the reason behind the deeper penetration?

Ps: Don’t compare the following data sets by total pan card holders or total population, proper comparsion would be total households (i.e 30cr)

Here’s your answer - It’s because the access to a beautiful financing products by NBFC’s like bajaj finance - most of the bikes bought are on EMI’s

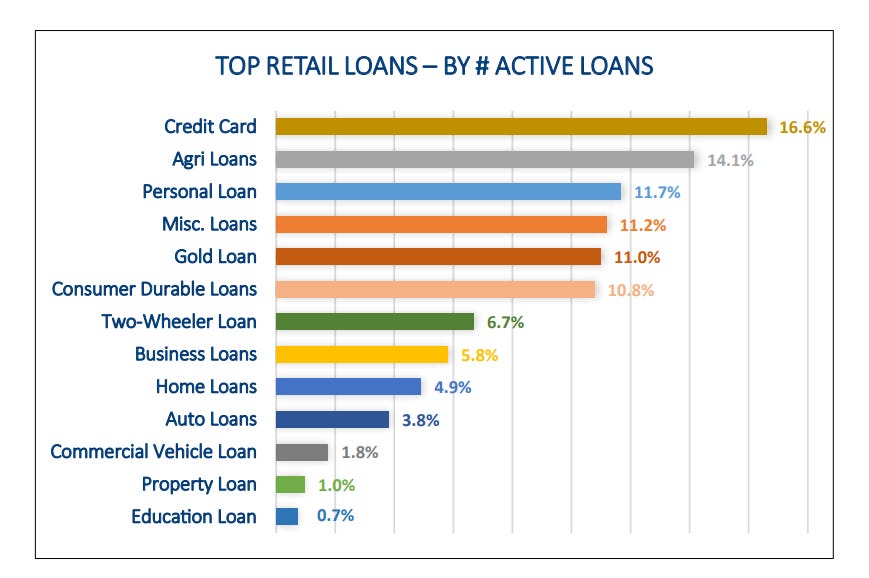

Also the very reason, we have deeper penetration of laptops, washing machines, smartphones is because of lending products 👇:

Most of the educational, healthcare, Hopium products and high investment products are bought or used using personal loans.

I have more interesting data for you to explain how India is dependent on credit for big purchases - this keeps me thinking the probability of a purchases is directly correlated to the availbility of credit?

There are also scenarios where many have taken loans from their circles but there is also another instrument called chits that many households are invested in - best lending instrument with less interest rate..

You might think most of the purchases are less frequent and it doesn’t validate that most of the spends are credit driven

well wait i have something interesting for you..

Debit card VS credit card

Debit cards are 12x more of credit cards in India, yet both of them have same volume of transactions in online purchases - the value for credit transactions is 3.5x of debit.

Also debit card has many volume of transactions at POS system but credit and debit cards have same value of transactions at POS systems..

Cash withdrawal is obvious that debit cards win that game..

UPI has made 6.5B volume of transactions in a month, total value of transactions is more than $130B + - this numbers look fancy but there is huge power law..

Top 5% of the users will easily contribute to higher % volume and value of transaction

In my opinion, most of the money Indian’s have in their bank accounts is floating money - they don’t own it, their bank accounts are used as channels to send money..

The stats are going to be stonks if credit on UPI goes live on a large scale - you will see the average transaction value, frequency of transactions and value of transactions rising up..

Final thoughts: I believe for Indian users there are triggers that makes them take a risk taking decision but if there is no access to credit that risk can’t be executed - India’s spends are massively driven by credit and we have barely scratched the surface..

Wait, Remember in the beginning of the newsletter I told i have something exciting for you..

Here it is, in the last 3 months many people have texted me on my dms on how they can contribute to the newsletter financially, so i have opened up an opportunity for you to give towards this newsletter, will only open up the opportunity to give once a month or once in 2months.

If you find the content insightful and it is helping you, you can give here - https://rzp.io/l/JA9uheTSK

Two things that fascinated me this week:

The secret to build a good network effect business is It has to be the mix of DAU’s ,ARPU’s — finding a market that could give you massive DAU and another that could give you high ARPU..

D2C businesses are high gross margin businesses, most of the D2C businesses i have read about have scaled well and are extremely profitable - but this is opp for Indian D2C businesses - I don’t know the answer for this but trying to learn and seek truth..

If you have any thoughts share them in the comments :)

If you found this insightful, do drop a like and tap on share.

A ❤️and share on LinkedIn / Twitter would definitely mean a lot.