How do Indian Immigrants contribute to Indian economy?

I am Aarihant Aaryan! Welcome to the Iron sharpen Iron newsletter,

Every week I share my homework from my startup journey, learning about human behavior, and sometimes decoding industries and business models for fun.

I can’t control my curiosity :) )

Many Indians think, that Indian immigrants don't contribute to the Indian economy.

Yes, that Sharma Ji ka beta, does contribute to the Indian economy,

Here’s some in-depth analysis for you

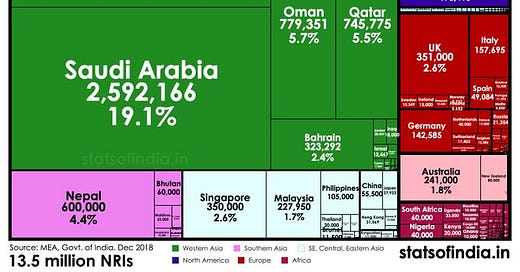

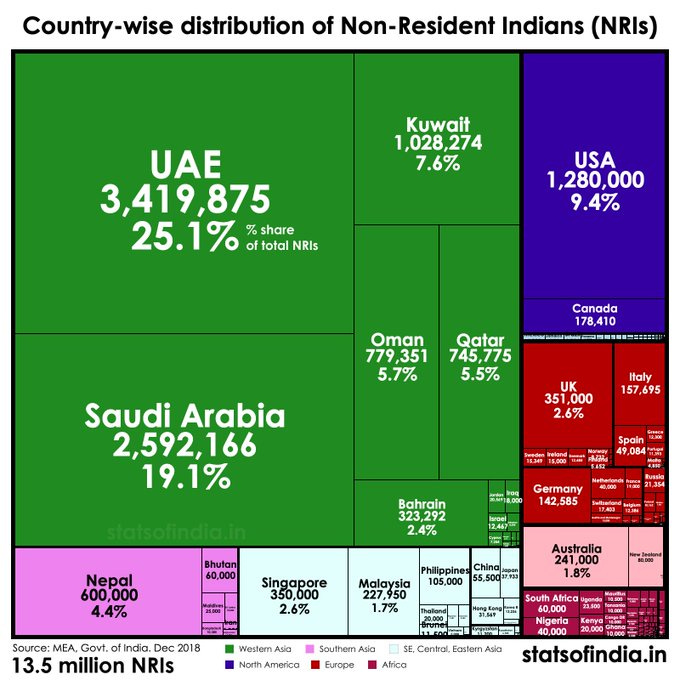

Total Immigrants:

There are a total of 13.5M NRIs - more than 62% of them are located in the middle east and 9.4% of them are located in the USA.

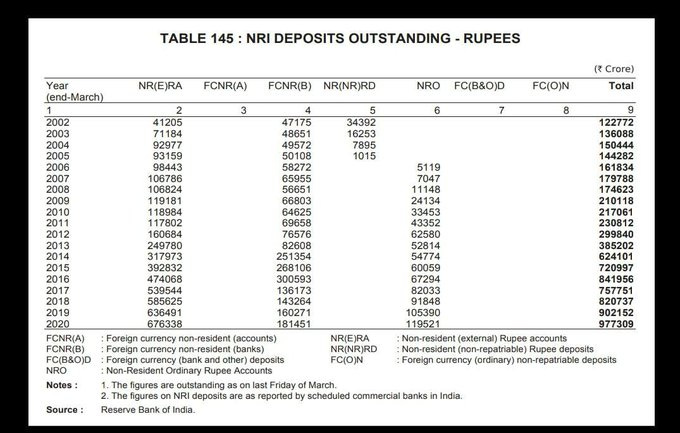

Total deposits by NRI:

More than 1,81,451 lakh crore INR is deposited by the NRI's in their FCNR accounts. FCNR takes deposits in dollars and adds a fixed interest - this also helps the country solve for the balance of payments, and foreign reserves.

Total remittance received:

India received more than $85billion (6.8 lakh crore) in 2020 as personal remittances. India is the largest remittance-receiving country - only remittance made up 3.1% of the country's GDP.

82 percent of the total remittances received by, India originated from seven countries, viz., the United Arab Emirates (UAE), the United States (US), Saudi Arabia, Qatar, Kuwait and etc

UAE - India

Indians are the largest migrant group in the UAE. This makes India the largest recipient of remittances from the UAE Indian migrants in UAE send $18.5 billion to India in remittances Acc to the World Bank remittances from UAE contributed 0.68% to India's GDP in 2018

USA - India

Remittances sent from the US to India grew from $11.7 billion in 2017 to $12.7 billion in 2018 There are over 2.4 million Indians living in the US. 80% of them send remittances to India Also, around 9 billion from India to the US are sent for college tuition, etc

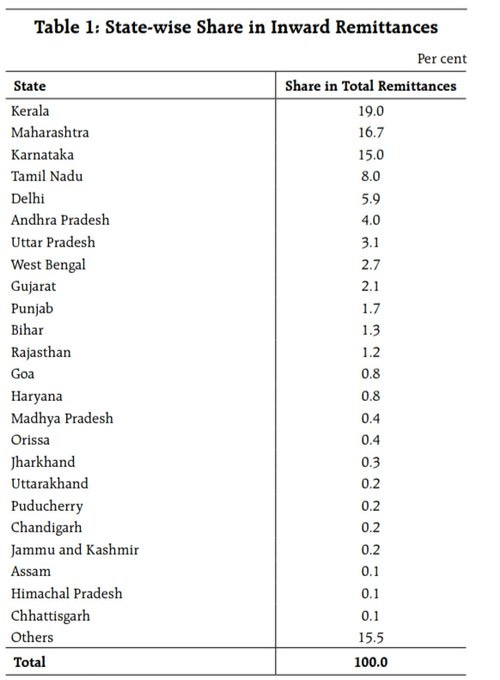

State-wise remittance:

58.7 percent of total remittances were received by four states namely Kerala, Maharashtra, Karnataka, and Tamil Nadu.

The most common parameter among all the cities that receive a high inward remittance rate is most of them have higher per capita income.

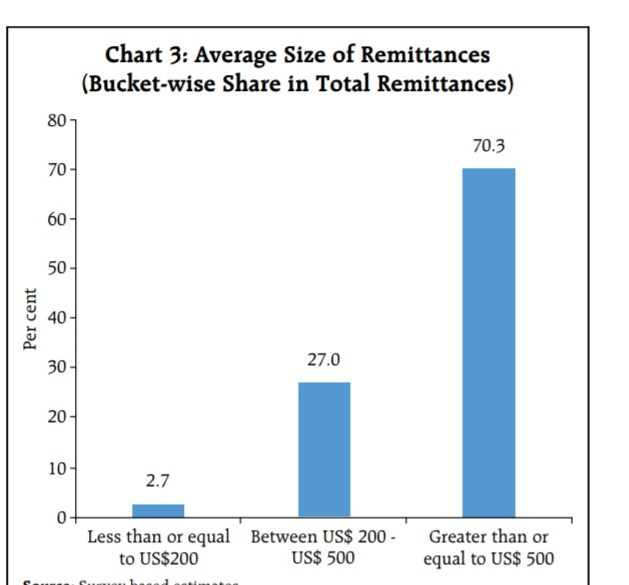

Avg value of remittance:

70.3 percent of all reported transactions were of more than or equal to US$500 and only 2.7 percent were of less than or equal to US$200 category.

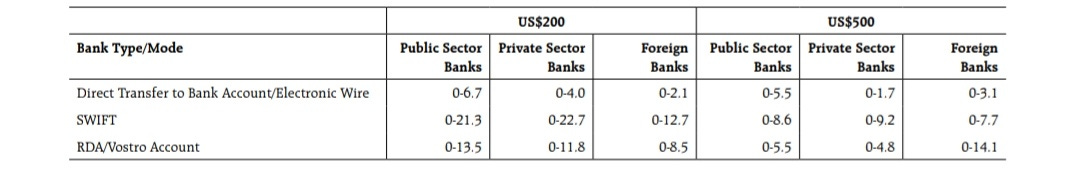

Mode and cost for remittance:

The cost for one remittance transaction is 3.27% to 5% of a transaction. The most preferred method is the Vostro account - it is an account a correspondent bank holds on behalf of another bank.

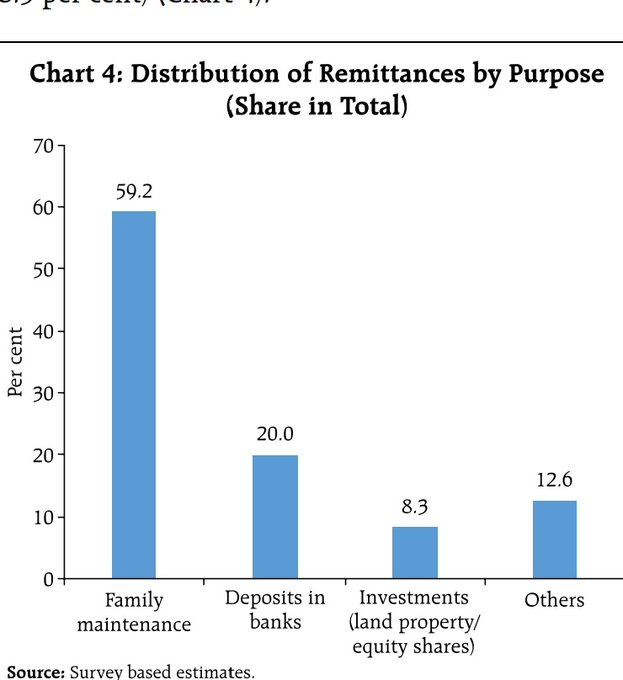

How remittance is used:

It is estimated that more than half of the remittances received by Indian residents were used for family maintenance. (i.e., consumption), followed by deposits in banks (20 percent) and investments in land property

Final thoughts:

Indian immigrants are highest in transferring wealth back to homes, this is the most common behavior between a 3rd world country and 1st world country.

I.e US to Mexico - In 2017, more than $34.70 billion were sent as remittances to Mexico.

This keeps me thinking that in the last few centuries people traveled and exploited countries and sent wealth back home.

Now it's the same but people are doing it rightfully with all their hard work.

Two things that fascinated me this week:

The launch of CRED pay- that’s a big bet and move. I have been hearing a lot about the product from my friends at CRED, and can’t wait to see how it pans out - A detailed thread coming up on cred pay this Tuesday.

Bajaj electronics has close to 500k outlets across India Every retail store has a Bajaj finance kiosk On Avg every day, 1 new loan account is created per outlet Which is 500k loan accounts created p.d best way to increase credit penetration is by placing it at high intent places

If you have any thoughts share them in the comments :)

If you found this insightful, do drop a like and tap on share.

A ❤️and share on LinkedIn / Twitter would definitely mean a lot.