The world of insurance hasn’t been the same. It is rapidly changing and evolving.

The insurance market is changing in countries where mainly it is a norm not just an option.

But the biggest unlock even today is how the Insurance is being distributed.

In 1985, New York life insurance was $ 10 billion in annual premiums, and mass mutual life insurance was $ 1 billion in annual premiums. As Mass Mutual pivoted to new ways of distribution as of 2023 they grew by 9x to achieve $9.2B in annual premiums and New York Life Group grew by 30% in 2 decades to crack $13B in annual premiums

The problem has always been that with the traditional approach, you don’t own the customer:

If the existing relationship manager/sales rep makes a move, consumers are less likely to discontinue or be retained for your insurance products. With the traditional approach, the sales agents carry the clientele as their distribution everywhere.

There have been many tech-led initiatives by the biggest financial service companies to build a massive distribution, sharing them here:

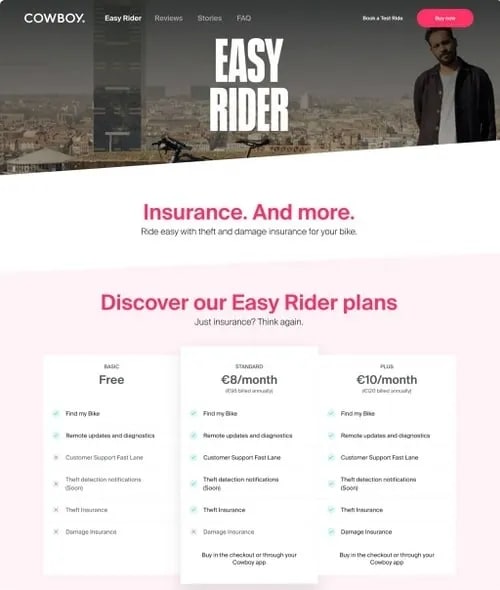

Embedded way of insurance:

Embedded insurance, part of a broader movement towards embedded finance, is about getting more affordable, relevant, and personalised insurance for people when and where they need it most.

It is more like “add-on insurance” that could be easily integrated with high-frequency use cases for ex: Paying bills, making payments, Booking a cab, ordering food, booking travel tickets or making online purchases.

As more business moves online a long tail of smaller retailers and product manufacturers with razor-thin margins are looking to offer add-on services like theft and damage protection at point of sale. They need to be tailored to the niche requirements of their customers, affordable and flexible. For some, these sorts of ancillary services can equate to up to 50% of their net profits

B. Uber is another big online platform with a close relationship with its users including its 3 million drivers worldwide.

At any one time, depending on local regulations, competitive threats and new market opportunities, Uber requires the flexibility to provide its drivers with different types of insurance, benefits and incentives, related to vehicle and personal injury coverage, sickness, paternity pay or other income loss.

Some of its insurance solutions are provided to drivers for free, some are invisible, and some are optional add-ons. Some are related to when the driver is ‘in service’, some not.

In all cases, Uber prides itself on the simplicity of its user experience and requires insurance solutions that are easy to adopt, good value and quick to claim against. The problem has been that traditional insurers have not been attuned to the need for such flexible, niche products at the speed that Uber moves and within categories that are new to the industry. Drivers are not ‘employees’, Uber does not own a ‘fleet’, its drivers don’t want ‘annual policies’, and any downtime is lost income.

As a result, Uber, like other digital native organisations, is increasingly working with a new breed of insurers (‘digital MGAs’ and others) who are providing more relevant solutions that can be embedded more easily in their driver experiences.

C. Insurers can also benefit from embedding other financial services into their offerings. For example, SingLife recently worked with Railsbank to offer a combined savings, spending, investment and insurance plan with a Visa debit card and no withdrawal restrictions, to create a closer, daily relationship with its customers and gather more data on their habits.

In the past, this would have been complicated, costly and time-consuming to launch such a service. SingLife managed to launch its new product within a few months.

Even if automotive claims can be processed quickly today with camera phones, disbursements are often made by cheque (costing insurers $10 each time!). Insurers can now use real-time payments from bank-as-a-service platforms to improve this poor experience

Today, If you look at countries that have higher internet penetration like India, the USA or even China - all of them have moved their point of contact with consumers to “Tech”

Build a mobile or web-first approach to learning, buy, manage and claim insurance

Lemonade Insurance built a consumer-facing product and gained distribution via performance marketing, they achieved $450M in revenue

In fact, max life insurance in India the biggest competitor to LIC insurance has Gross Written Premium of $4 Billion , Assets Under Management is Rs. $25B+ and their revenues for FY24 $4.5B

They achieved this scale with just 19,000 employees.

It's because they optimised for tech to create operational efficiency, for instance they built a Mobile App for consumers to learn, buy, renew and claim their insurance.

They built internal tools for their agents to track productivity, conversions, upload paper work and disburse layouts.

Policy Bazaar, Turtlemint: POSP Model

IRDAI introduced the Point of Sales Person (PoSP) model to make it easier to sell simple insurance products and drive penetration.

This model is a compelling blend of technology and a human interface that makes the insurance journey smoother and more credible for consumers.

The PoSP model is a win-win for consumers, agents, and insurers. The model has seen rapid adoption with over 20 lakh PoSP agents in India. It gives agents better earning opportunities, insurers get the ideal means to tap underserved sections, and customers can have a local touchpoint to all their insurance needs.

PoSP model lies in the empowerment of agents through comprehensive training, access to advanced technology, and attractive compensation structures.

This empowerment enables agents to provide personalised guidance and support to policyholders, facilitating informed decision-making in insurance purchases. By seamlessly integrating traditional agent networks with digital tools, the PoSP model enhances distribution efficiency while preserving the human touch in sales interactions

The PB Partner network is spread across 19.1k pin codes across India. All in all, Tier-II and Tier-III cities account for almost 50 per cent of the incoming business.

Leverage Telecom Providers:

There’s been an interesting partnership between Telecom companies X insurers, there have been users not paying bills on time, and introducing Bill Protect Act, an innovative solution that addresses the issue of late or unpaid bills by providing a safety net for service providers and consumers alike.

Similarly, Orient could partner with DU Telecoms, and Saudi Telecom and sell a low ticket-size insurance plan that consumers could pay with the billing. The method has worked globally very well.

A. Airtel Insurance (India): Airtel partnered with Bharti AXA Life Insurance to offer life insurance to its customers. The offering was a term life insurance plan with a sum assured of ₹1 lakh (approximately USD 1,370).

Scale: Over 1 million policies sold within the first year.

B. MTN Insurance (South Africa): MTN partnered with Sanlam to offer life insurance to its customers. The offering was a funeral insurance plan with a sum assured of R10,000 (approximately USD 670).

Scale: Over 2 million policies sold within the first year.

C. Ooredoo Insurance (Indonesia): Ooredoo partnered with Asuransi Jiwa Sinarmas to offer life insurance to its customers. The offering was a term life insurance plan with a sum assured of IDR 10 million (approximately USD 670).

Scale: Over 1 million policies sold within the first year.

Dittoinsurance - content-led insurance

The modern consumer is much different, they are much influenced by the internet - most of their decisions made by them are influenced by the content they have consumed.

Ditto built a library of educational content on their website for anyone to browse and learn without any pressure – no collection of phone numbers or email addresses that lead to harassing calls or spam.

They hired insurance freshers as an ‘advisory’ team on salary, gave them 3 months of training per category and then no sales targets. The incentives do include closing deals but with customer satisfaction. They don’t have any complaints of mis-selling on the contrary, customers rave about them and give them referrals.

They built the tech to make the advisory team more productive including calculating and comparing premia for policies across companies in minutes.

Their marketing funnel is still the much-loved newsletter and some affiliate marketing with influencers.

Affinity Group:

Affinity group-based Insurance sales target a cohort of consumers that have similar needs, similar geography or similar behavioural characteristics. The use case could be a company providing insurance to its employees, a non-profit org providing insurance for people they care about, or a doctor association/community providing insurance to their community.

In the USA, many companies have cracked huge distribution and impact by choosing to sell insurance via affinity groups, for instance, for over 70 years USI Affinity has been recognized as an industry leader, consistently among the top Affinity Insurance Administrators in the United States serving more than 400 partner organizations and representing more than 20 million members.

In 2017, private equity firm KKR and institutional investor CDPQ acquired USI Insurance Services from Onex Corporation for $4.3 billion

Today, USI has more than $2.7+ billion in revenue and over 10,000 associates across 200+ offices nationwide.

If you found this insightful, do share it with someone who may need it :)

Share